A short term fix, but here’s the problem described towards the end of the article…

Where does the Fed get all the money? It prints it.

The bond market and gold markets both rallied. Long term debt rallied as the number of buyers increased for the same amount of supply so the treasury can offer lower interest rates. Gold rallied due to inflation fears for the reason given above.

Gold rallies $50/oz on Federal Reserve announcement.

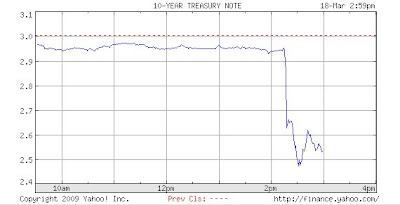

An amazing fall in yield of the 10 year Treasury note of almost 1/2%. Note that a falling yield is equivalent to a rising bond price.

added at 21:34pm on 3/19…

More on this potential fiasco over at Christopher Fountain’s blog.

Yesterday I heard an economist on NPR predict that the Fed would not buy long term bonds because it was “a last ditch stand” ; its potential to explode inflation was so huge. “Like firing an unguided missile”, he said.

Hat-tip to Instapundit.